Contents:

Your business needs to record unearned revenue to account for the money it’s received but not yet earned. Recording unearned revenue is important because your company can’t account for it until you’ve provided your products or services to a paying customer. There are situations whereby companies receive payment from customers for goods or services that are yet to be provided. This income received is not earned yet as the company has a financial obligation to the customer.

Although both terms seem different, they represent the same type of revenue. Adjusting entries ensure that the accrual principle is followed when recording incomes and spending. Closing entries are those that are used to close temporary ledger accounts and transfer their balances to permanent accounts. Interest expense arises from notes payable and other loan agreements.

What is Deferred Revenue?

Taxes are only paid at certain times during the year, not necessarily every month. Taxes the company owes during a period that are unpaid require adjustment at the end of a period. Accounts Receivable increases for $1,500 because the customer has not yet paid for services completed.

This implies that all the revenue that was previously received in the form of customer advances recorded as unearned revenue would be zero. All the amount would have been recognized and subsequently recorded as revenue. First of all, deferred income cannot be recorded as regular income until the contract terms are fulfilled completely. Therefore, applying accrual accounting principles and using unearned revenue as a liability rather than income becomes more of a responsibility than a choice. Many businesses receive revenue before they actually provide a good or service. This is called unearned revenue; it is classified as a liability until the good or service is produced.

Unearned revenue can only be recorded for entities using accrual accounting. Entities using cash accounting cannot record unearned or deferred revenue. If they receive income before delivering services or goods, they will record it as a cash advance payment rather than deferred income. However, companies still need to record the cash received from their customers to reflect a true and fair position on their financial statements. Until the company makes the sale, the amount paid by the customer is an obligation that will result in a future economic outflow. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account.

Therefore any unearned income should not be recognized as revenue and should be treated as a liability until the mentioned conditions are fulfilled. The major difference between the two methods is the timing of recording revenues and expenses. In the cash method of accounting, revenues and expenses are recorded in the reporting period that the cash payment is made.

Divide the amount received for providing goods or rendering services by the number of months of services/goods for which the amount is received. For example, professional fees of $6,000 are received for six months. Therefore $6,000 divided by 6, which is $1,000, would be recognized as monthly income. Unearned revenue is recorded as a debit to Cash account and credit to Unearned Revenue account. The deferred income concept allows for applying the matching principle of accrual accounting. Deferred revenue refers to the revenue earned in advance by an entity when it has already received the revenue but the delivery of goods or services is pending.

Accounting: What the Numbers Mean

At that time, you can transfer the entire $25,000 from unearned revenue to an earned revenue account. Unearned RevenueUnearned revenue is the advance payment received by the firm for goods or services that have yet to be delivered. In other words, it comprises the amount received for the goods delivery that will take place at a future date. Unearned revenue is the advance payment received by the firm for goods or services that have yet to be delivered. Accrual accounting that refers to expenses that are recognized when incurred but not yet paid.

There are many types of unearned or passive income, including interest from savings accounts, bond interest, alimony, and dividends from stocks. Unearned revenue refers to the compensation or payment received by an individual or an organization for products or services that are yet to be delivered or produced. These prepayments help companies to better their cash flows and produce the product or service with lesser hassle. By the end of the fiscal year, you will have delivered all 12 magazines for the year, and the balance on your deferred revenue account will amount to zero.

Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. Advance PaymentAdvance payment is made by a buyer to the seller before the actual scheduled time of receiving the goods and services. Additionally, it helps sellers financially in the production of the goods or rendering of services. Current LiabilityCurrent Liabilities are the payables which are likely to settled within twelve months of reporting. They’re usually salaries payable, expense payable, short term loans etc.

Accounting for Unearned Revenue – Explained

The revenue is transferred from the unearned revenue to the earned revenue account (i.e. sales revenue) once the product or service has been delivered to the customer. The unearned revenue definition is the revenue a business receives before providing a good or service. Unearned revenue is similar to a prepayment on behalf of the customer. For example, if a customer purchases a policy from an insurance company at the beginning of the year and pays for twelve month of coverage, the payment made is considered unearned revenue.

- Cash basis accounting is an accounting system that recognizes cash when received and bills when paid.

- In the cash method of accounting, revenues and expenses are recorded in the reporting period that the cash payment is made.

- As mentioned earlier, when customers pay in advance, it impacts the bank account and the unearned revenue account.

When a company purchases supplies, the original order, receipt of the supplies, and receipt of the invoice from the vendor will all trigger journal entries. This trigger does not occur when using supplies from the supply closet. Similarly, for unearned revenue, when the company receives an advance payment from the customer for services yet provided, the cash received will trigger a journal entry. When the company provides the printing services for the customer, the customer will not send the company a reminder that revenue has now been earned.

Since this is a liability from the standpoint of the company, it always has a credit balance. This is because the company has received the amount, but has not yet earned the amount. Therefore, the accrual method of accounting is more commonly used, especially by public companies.

The chart of accounts should give anyone who is looking at it a rough idea of the nature of your business by listing all the accounts involved in your company’s day-to-day operations. Companies in different lines of business will have different looking charts of accounts. The chart of accounts for a major airline will have a lot more references to “aircraft parts” than your local cat cafe. Below, we’ll go over what the accounting chart of accounts is, what it looks like, and why it’s so important for your business.

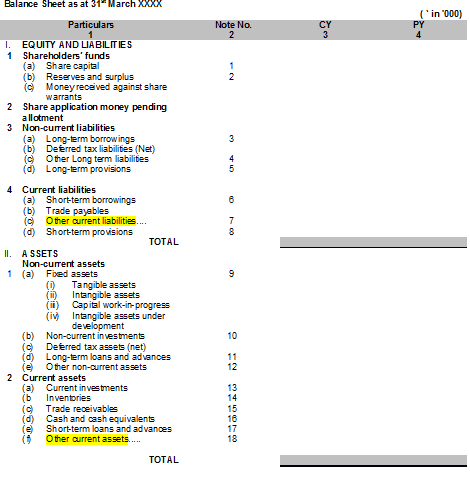

The deferred payments are recorded as current liabilities in the balance sheet of a company as the products or services are expected to be delivered within the current year. Once the goods or services are delivered, the entry is converted to a revenue entry through a journal. Unearned revenues are classified as liabilities in the current liabilities section of the balance sheet.

The utility is consumed in one month, and the bill is received in the next month. Unearned revenue reported earlier needs to be reversed if the contract does not complete satisfactorily. In this case, Unearned Fee Revenue increases and Cash increases for $48,000. The inefficiency of recording every single day-to-day event, such as the use of supplies. One difference is the supplies account; the figure on paper does not match the value of the supplies inventory still available.

Recall that depreciation is the systematic method to record the allocation of cost over a given period of certain assets. This allocation of cost is recorded over the useful life of the asset, or the time period over which an asset cost is allocated. The allocated cost up to that point is recorded in Accumulated Depreciation, a contra asset account.

By moving the unearned revenues is what type of account with an adjusting entry at the end of the month, it is recognized in the month that the revenue was earned. If all of the money is not earned, such as a cancelled contract, the transaction must be handled differently. In our example of ABC Company’s pallets, two months after the customer pays, the pallets are produced and delivered to the customer. To recognize the revenue now that it is earned, you will do an adjusting entry to move the money from unearned revenue to sales revenue.

Auburn National Bancorporation, Inc. Reports First Quarter Net … – GlobeNewswire

Auburn National Bancorporation, Inc. Reports First Quarter Net ….

Posted: Tue, 25 Apr 2023 12:05:00 GMT [source]

A chart of accounts is the list of the accounts in a given firm’s ledger E. A chart of accounts is the list off accounts deemed suitable for firms belonging to a particular industry. According to the IRS, there are two possibilities that affect the reporting of a child’s unearned income. Any unearned income above $2,200, such as interest or dividends, may be subject to an unearned income tax. Alternatively, interest and dividend income of less than $11,000 may be included on the parent’s return rather than that of the child.

Since the company receives money through either cash or bank, it must increase the related account with a debit entry. On the other hand, it must also increase its liabilities through a credit entry. The name for the account it uses may be unearned revenues, deferred revenues, advances from customers, or prepaid revenues. Deferrals are prepaid expense and revenue accounts that have delayed recognition until they have been used or earned.

In the reporting period that the cash is paid, the company records a debit in the prepaid asset account and a credit in cash. In the later reporting period when the service is used or consumed, the firm will record a debit in expense and a credit to the prepaid asset. Although it is easier to use the cash method of accounting, the accrual method can reveal a company’s financial health more accurately. It allows companies to record their sales and credit purchases in the same reporting period when the transactions occur. A reporting entity must follow the accounting principles to record the unearned revenue in its financial statements. Using the table provided, for each entry write down the income statement account and balance sheet account used in the adjusting entry in the appropriate column.

As the prepaid service or the business gradually delivers the product over time, it is recorded as revenue on the income statement. As previously stated, unearned revenue is usually recorded as a current liability on a company’s balance sheet. If for example, a publishing company accepts $1,200 for a year subscription, the amount will be recorded as an increase in cash as well as an increase in unearned revenue. Both are balance sheet accounts, so the transaction will not have an immediate effect on the income statement. If it is a monthly publication, the liability or unearned revenue will be reduced by $100, that is, $1,200 divided by 12 months while revenue is increased by the same amount. The journal entry to record unrecorded revenues is straightforward.

As a result of this prepayment, the seller now has a liability equal to the revenue earned until deliver of the good or service. It is that income which is received but not yet earned, In other words you got paid for a service that you have not yet provided or got paid for goods that are not yet sold. Watch this short video to quickly understand how accrued expenses work. Adjusting entries are always done for the amount that has been used or the amount that hasn’t expired. Did we continue to follow the rules of adjusting entries in these two examples? Depreciation Expense increases and Accumulated Depreciation, Equipment, increases .

The unadjusted trial balance may have incorrect balances in some accounts. Recall the trial balance from Analyzing and Recording Transactions for the example company, Printing Plus. She would then make an adjusting entry to move all of the plaster expenses she already had recorded in the “Lab Supplies” expenses account into the new “Plaster” expenses account. One cannot always count on clients to pay on time and not getting paid can affect one’s cash flow, especially if a late payment means suddenly spending more than what is earned in a month. In this case, the best defense is collecting revenue in advance before starting a new project. By charging a deposit upfront, one will keep cash flow positive thereby staying afloat.

HAGENS BERMAN, NATIONAL TRIAL ATTORNEYS, Encourages … – GlobeNewswire

HAGENS BERMAN, NATIONAL TRIAL ATTORNEYS, Encourages ….

Posted: Sat, 15 Apr 2023 07:00:00 GMT [source]

These are the assets that are paid for and which gradually get used up during the accounting period. It’s similar to the example of pre-paid insurance premium we discussed above. Salaries Expense increases and Salaries Payable increases for $12,500 ($2,500 per employee × five employees). The following are the updated ledger balances after posting the adjusting entry. Let’s say a company has five salaried employees, each earning $2,500 per month.

REGIONAL MANAGEMENT CORP. MANAGEMENT’S DISCUSSION … – Marketscreener.com

REGIONAL MANAGEMENT CORP. MANAGEMENT’S DISCUSSION ….

Posted: Fri, 05 May 2023 20:11:17 GMT [source]

Supplies Expense is an expense account, increasing for $150, and Supplies is an asset account, decreasing for $150. This means $150 is transferred from the balance sheet to the income statement . There is still a balance of $250 (400 – 150) in the Supplies account.

Recent Comments