While the cost of equity is an expensive form of capital, companies with too much debt have a higher risk of defaulting on their debts. Because of this, investors like to see a healthy mix of financing through both debt and equity. WACC, or weighted average cost of capital, is one way to measure that mix. While the cost of debt is the rate of return that lenders expect from borrowers, the cost of equity is the rate of return that shareholders expect from companies they hold partial ownership in. The cost of equity is typically higher than the cost of borrowed money because equity financing does not have any tax advantages.

Interest paid by the firm on its current debt can be used as an estimate of the current cost of debt if nothing has changed since the firm last borrowed. However, when conditions have changed, the analyst must estimate the cost of debt reflecting current market interest rates and default risk. The after-tax cost of debt generally refers to the difference between the before-tax cost of debt and the after-tax cost of debt, which is dependent on the fact that interest expenses are deductible. It is an integral part of WACC, i.e., average weight cost of capital. The company’s capital cost is the sum of the debt cost plus the equity cost. The cost of debt is the minimum rate of return that the debt holder will accept for the risk taken.

As a preface for our modeling exercise, we’ll be calculating the cost of debt in Excel using two distinct approaches, but with identical model assumptions. To get our total interest, we’ll multiply each loan by its annual interest rate, then add up the results. Although you can use Excel or Google Sheets for bookkeeping, it’s helpful to know how to be your own cost of debt calculator. Suppose you run a small business and you have two debt vehicles under the enterprise. The first is a loan worth $250,000 through a major financial institution. The first loan has an interest rate of 5% and the second one has a rate of 4.5%.

The difference between the expected rate of return and the promised rate can be substantial. A practical alternative is to use the YTM for a number of similarly rated bonds of other firms. Such bonds include a so-called default premium, which reflects the compensation that lenders require over the risk-free rate to buy noninvestment grade debt. This methodology assumes that the risk characteristics of the proxy firms approximate those of the firm being analyzed. Table 18.2 summarizes methods commonly used for valuing cross-border M&As for developed-country and emerging-country firms. The WACC calculation assumes that the firm uses only common equity and debt financing.

How the Cost of Debt Works

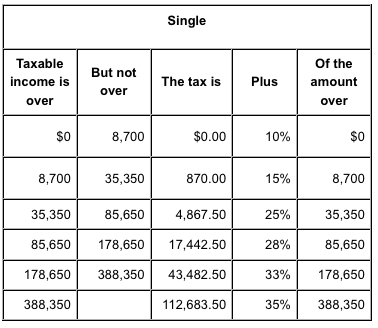

Because your tax rate is 40%, that means you end up paying $40 less in taxes. Suppose a company named AIM Marketing has taken a loan for business expansion of $500,000 at the rate of interest of 8%. The tax rate applicable was 30%; here, we have to calculate the after-tax cost of debt. In this guide, you will learn about the cost of debt, as well as how to calculate it before and after taxes have been paid. You will also learn how to use Microsoft Excel or Google Sheets to calculate the cost of debt and how a tool like Layer can help you synchronize your data and automate calculations. With debt equity, a company takes out financing, which could be small business loans, merchant cash advances, invoice financing, or any other type of financing.

Loan providers want to ensure that borrowers are able to pay them back. To lower your interest rates, and ultimately your cost of debt, work on improving your credit score. Calculating the total cost of debt is a key variable for investors who are evaluating a company’s financial health. The interest rate a company pays on its debt will determine the long-term cost of any business loan, bond, mortgage, or other debts a company uses to grow. Interest is the cost of borrowing and is tax deductible by the firm; in bankruptcy, bondholders are paid before shareholders as the firm’s assets are liquidated. Default risk is the likelihood the firm will fail to repay interest and principal when required.

You can calculate the after-tax cost of debt by subtracting your income tax savings from the interest you paid to get a more accurate idea of total cost of debt. We discuss how to calculate complex cost of debt below, which includes the impact of taxes. The effective interest rate is the weighted average interest rate we just calculated. For example, if a company’s only debt is a bond that it issued with a 5% rate, then its pretax cost of debt is 5%. If its effective tax rate is 30%, then the difference between 100% and 30% is 70%, and 70% of the 5% is 3.5%.

Mergers and acquisitions cash flow valuation basics

Follow the steps below to calculate the cost of debt using Microsoft Excel or Google Sheets. Cost of debt refers to the total interest expense a borrower will pay over the lifetime of the loan. Therefore, the final step is to tax-affect the YTM, which comes out to an estimated 4.2% cost of debt once again, as shown by our completed model output.

Even though you’re paying your friend $100 in interest, because of the $40 in savings, really you’re only paying an additional $60. The after-tax cost of debt is lower than the pre-tax cost of debt. For example, let’s say your friend offers you a $1,000 loan at 10% interest, and your company’s tax rate is 40%. The effective pre-tax interest rate your business is paying to service all its debts is 5.3%. Optimize Business Growth

Increasing business income allows one to avail more debt as they can afford it, thereby reducing the cost of debt by comparing it with the income generated by the loan amount.

Simply put, a company with no current market data will have to look at its current or implied credit rating and comparable debts to estimate its cost of debt. When comparing, the capital structure of the company should be in line with its peers. Some interest expenses are tax deductible, meaning you will receive a tax break for some of your interest paid and won’t actually have to pay for all the interest charged.

Calculating the Cost of Debt

Each year, the lender will receive $30 in total interest expense twice. On the Bloomberg terminal, the quoted yield refers to a variation of yield-to-maturity (YTM) called the “bond equivalent yield” (or BEY). To find your total interest, multiply each loan by its interest rate, then add those numbers together. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

Analysis: Fed decoupling boosts emerging market stocks, cools … – Reuters

Analysis: Fed decoupling boosts emerging market stocks, cools ….

Posted: Tue, 08 Aug 2023 11:20:00 GMT [source]

It reflects the current level of interest rates and the level of default risk as perceived by investors. In bankruptcy, bondholders are paid before shareholders as the firm’s assets are liquidated. Default rates vary from an average of 0.52 percent of AAA-rated firms for the 15-year period ending in 2001 to 54.38 percent for those rated CCC by Standard and Poor’s Corporation (Burrus and McNamee, 2002). The cost of debt is the interest rate a borrower must pay on borrowed money, such as bonds or loans. A company’s total cost of debt is calculated by adding total interest expense and dividing it by total debt. The cost of debt is a critical measure because it directly impacts a company’s profitability and cash flow.

How to Calculate Cost of Debt (With Examples)

Because interest rates have been rapidly rising throughout 2022 and may continue to rise in early 2023, it may be difficult to find low-interest rate options. If that’s the case, you may want to consider ways to get out of debt or reduce the debt at your company. Federal Reserve, 43% of small businesses will seek external funding for their business at some point—most often some kind of debt. Knowing the after-tax cost of the debt you’re taking on is crucial when trying to stay profitable.

She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

- Get instant access to video lessons taught by experienced investment bankers.

- Suppose a company named AIM Marketing has taken a loan for business expansion of $500,000 at the rate of interest of 8%.

- Capital structure deals with how a firm finances its overall operations and growth through different sources of funds, which may include debt such as bonds or loans.

- This “synthetic” credit rating is obtained by comparing financial ratios for the target firm to those used by US rating agencies.

The degree of the cost of debt depends entirely on the borrower’s creditworthiness, so higher costs mean the borrower is considered risky. For nonrated firms, the analyst may estimate the current pretax cost of debt for a specific firm by comparing debt-to-equity ratios, interest coverage ratios, and operating margins with those of similar rated firms. The analyst would then use the interest rates paid by these comparably rated firms as the pretax cost of debt for the firm being analyzed. Much of this information can be found in local libraries in such publications as Moody’s Company Data; Standard & Poor’s Descriptions, the Outlook, and Bond Guide; and Value Line’s Investment Survey. In the United States, the FINRA TRACE database also is an excellent source of interest rate information.

Will the Housing Market Crash? What You Need to Know About Today’s Market

Because money was so cheap to borrow, companies could thrive for years without ever producing a profit. Like any other cost, if the cost of debt is greater than the extra revenues it brings in, it’s a bad investment. Refinancing Loan

First, one needs to start a loan with a rate of interest he is eligible for; then, when the business starts growing, he can refinance the loan at a lower rate after some months of the loan. Now let’s take one more to understand the formula of interest expense and cost of debt.

- However, when interest rates began rising in 2022, borrowed money no longer looked so appealing.

- There are numerous ways to secure business capital, and debt financing is at the top of that list.

- The cost of debt is the after-tax effective rate paid by a borrower on its debt.

- If you don’t keep track of your cost of debt, those expenses can get out of control.

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. She has held multiple finance and banking classes cost of debt is same as its rate of interest for business schools and communities. In this example we have a total current (€ 14,500) and non-current (€ 5,100) liabilities of € 19,600. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

While the cost of debt is a critical measure to be aware of, it’s important to look at it in conjunction with other metrics. However, when interest rates began rising in 2022, borrowed money no longer looked so appealing. Companies had to scramble to cut costs, deleverage, and shrink down to a size that is sustainable in today’s high-interest rate environment. For many years, the tech industry took advantage of low-interest rates, using debt to fuel rapid growth.

While simply having any debt at all is by no means a bad thing for a business, being over-leveraged or possessing debt with too high of interest rates can damage a business’ financial health. Next, determine the company’s marginal tax rate (federal and state combined). For most large corporations, the federal marginal tax rate is 35%, as this rate applies to all income over $18.33 million. The use of these three measures has to be perfectly consistent with the free cash flow discounted and the perspective of the valuation. Acquirer Inc., a US-based corporation, wants to purchase Target Inc. The right business loan or line of credit can come with many benefits.

Recent Comments