Content

Accumulated depreciation is the total depreciation recorded for an asset over its useful life. When an asset is disposed of the credit balance in Accumulated Depreciation is reduced when the asset’s credit balance is removed by debiting Accumulated Depreciation. The company uses the fixed installment method of depreciation and estimates that the machine will have a useful life of 6 years, leaving a scrap value of $2,000. The balance of the provision for depreciation account is carried forward to the next year. In our PP&E roll-forward, the depreciation expense of $10 million is recognized across the entire forecast, which is five years in our illustrative model, i.e. half of the ten-year useful life. In order to calculate the depreciation expense, which will reduce the PP&E’s carrying value each year, the useful life and salvage value assumptions are necessary.

Under this method of depreciation, the total useful output of an asset is estimated. It requires an estimate of the total units that an asset will produce in its useful life. The depreciation expense is calculated annually based on the number of units produced.

Depreciation Expense Calculation

Negative depreciation may also be because of your accounting software. If your financial statements look wonky, there could be something wrong with how you use the tool or with the software itself. So, it’s always important to review your financial reports regularly to catch errors. Difference between the asset’s cost and its accumulated depreciation balance. A company is free to adopt the most appropriate depreciation method for its business operations.

If you use an asset, like a car, for both business and personal travel, you can’t depreciate the entire value of the car, but only the percentage of use that’s for business. A half-year convention for depreciation is a depreciation schedule that treats all property acquired during the year as being acquired exactly in the middle of the year.

AccountingTools

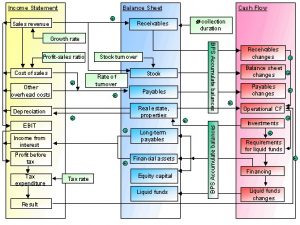

The formula for calculating the accumulated depreciation on a fixed asset (PP&E) is as follows. The concept of depreciation describes the allocation of the purchase of a fixed asset, or capital expenditure, over its useful life. Other times, accumulated depreciation may be shown separately for each class of assets, such as furniture, equipment, vehicles, and buildings.

- Between the total cost of the asset and the balance in the accumulated depreciation account.

- This means that, regardless of when the actual transaction is made, the expenses that are entered into the debit side of the accounts should have a corresponding credit entry in the same period.

- However, revenues may be impacted by higher costs related to asset maintenance and repairs.

- It is considered a contra asset account because it contains a negative balance that intended to offset the asset account with which it is paired, resulting in a net book value.

Companies can choose a method that allocates asset cost to accounting periods according to benefits received from the use of the asset. Depreciation expense can be calculated in a variety of ways; the method chosen should be appropriate to the asset type, the asset’s expected business use, and its estimated useful life. Depreciation expense reduces the book value of an asset and reduces an accounting period’s earnings. In the example we have been using, the cost of the equipment is $60,000, its scrap value is $5,000, and its useful life is 5 years. The estimated units of production over the useful life of the asset is 5,000.

Depreciation vs. Accumulated Depreciation

Accumulated Depreciationreflects the cumulative reduction in the carrying value of a fixed asset (PP&E) since the date of initial purchase. For tax purposes, the IRS requires businesses to depreciate most assets using the Modified Accelerated Cost Recovery System . For every asset you have in use, there is the “original basis” and then there’s the “accumulated depreciation” . Salvage ValueSalvage value or scrap value is the estimated value of an asset after its useful life is over.

These four methods of depreciation (straight line, units of production, sum-of-years-digits, and double-declining balance) impact revenues and assets in different ways. To calculate accumulated dep in balance sheet depreciation expense, use double the straight-line rate. For example, suppose a business has an asset with a cost of 1,000, 100 salvage value, and 5 years useful life.

Though working as a consultant, most of her career has been spent in corporate finance. Helstrom attended Southern Illinois University at Carbondale and has her Bachelor of Science in accounting. Accumulated depreciation depends on salvage value and the salvage value is determined as the amount that a company may expect to receive in exchange for selling an asset at the end of its useful life. It also aids in budgeting for future expenses for the replacement of assets. To find it, subtract the salvage value from the asset’s original cost, divide the result by the asset’s valuable life, and multiply by the number of years. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

However, there are situations when the accumulated depreciation account is debited or eliminated. For example, let’s say an asset has been used for 5 years and has an accumulated depreciation of $100,000 in total. Although it is reported on the balance sheet under the asset section, accumulated depreciation reduces the total value of assets recognized on the financial statement since assets are natural debit accounts. Accumulated depreciation is calculated using several different accounting methods.

Depreciation:

On the balance sheet, the carrying value of the net PP&E equals the gross PP&E value minus accumulated depreciation – the sum of all depreciation expenses since the purchase date – which is $50 million. By separately stating accumulated depreciation on the balance sheet, readers of the financial statement know what the asset originally cost and how much has been written off. It can also help them estimate the asset’s remaining useful life. Depreciation is expensed on the income statement for the current period as a non-cash item, meaning it’s an accounting entry to reflect the current accounting period’s value of the wear and tear of the asset.

This rate is then kept the same across all years the asset is depreciated and this continues to accumulate until the salvage value is arrived at. Accumulated depreciation is a way for businesses to track the decrease in the value of their assets over time. The most common method is the straight-line method, which considers the asset’s initial cost, scrap value, and valuable life. This method assumes a steady decrease in value over the asset’s life. Businesses should regularly check and update their depreciation calculations to ensure their financial statements are correct.

Is accumulated DEP a current liability?

Accumulated depreciation is not considered a liability because liability represents the obligation to pay, and accumulated depreciation is not a payment obligation to the entity. Instead, it is created for internal and valuation purposes.

Recent Comments